Hawaii offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Hawaii Regulated Electric Utilities

HEAR Energy Rebate Program

Variable Frequency Drive (VFD) Pool Pump

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Hawaii Government

415 S Beretania St., Honolulu, HI 96813

(808) 587-0478

[email protected]

Monday-Friday, 7:00 a.m. – 5:00 p.m.

Hawaiian Electric

425 W Capitol Ave

Little Rock, AR, 72201

Oahu: (855) 304-1212

Maui: (808) 871-7777

Molokai, Lanai: (877) 871-8461

Hawaii Island: (808) 969-6666

Hawaii State Energy Office

235 S. Beretania Street, 5th Floor

Honolulu, Hawaii 96813

(808) 587-3807

[email protected]

Monday-Friday, 8:00 a.m. – 4:30 p.m.

Honolulu Weather Bureau

2525 Correa Rd

Suite 250

Honolulu, HI 96822

(808) 973-5286

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Renewable Energy Technologies Income Tax Credit (RETITC) | 35% | Sales tax is exempt on specific solar equipment |

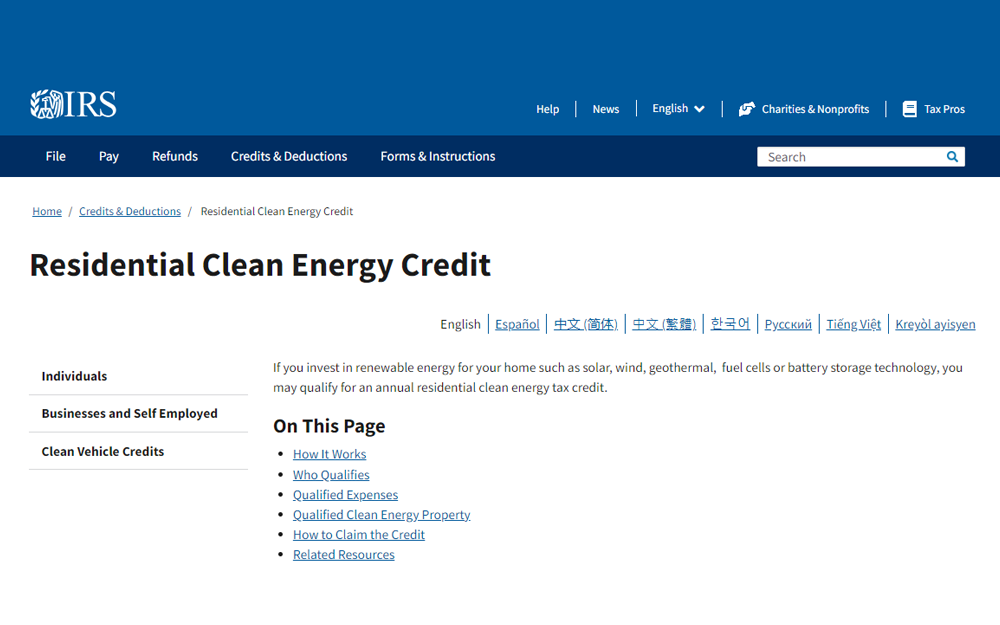

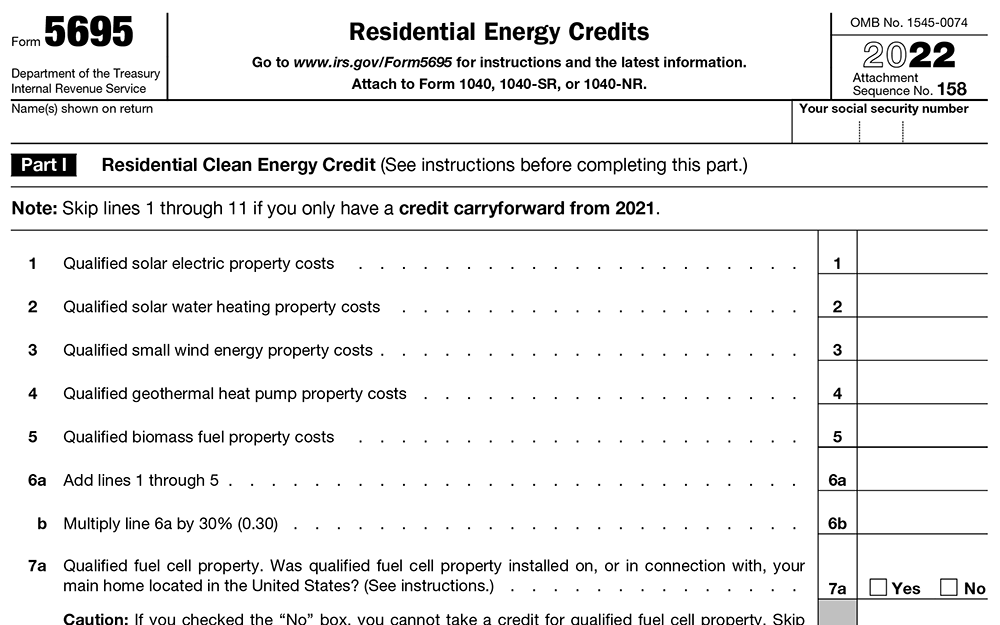

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Hawaii Clean Energy

EV Laws and Incentives

Power Outage Map

Solar for All

Energy Landscape

State Energy Office’s Open Data Portal

Contact

State of Hawaii Office of Planning and Sustainable Development

235 S Beretania St.

Honolulu, HI 96813, USA

(808) 587-2846

[email protected]

Hawaii Solar Tax Credits & Incentives

If you live in Hawaii, then you should know that you have access to plentiful solar tax credits, incentives, and rebates on the federal and state level.

The federal solar tax credit will recoup 30% of your investment, with no limit on the amount you claim, and the Hawaiian state solar tax credit will recoup 35% of your investment up to $5,000.

This guide provides all the information you need to know about how to decrease the cost of home solar installation and other Hawaii solar incentives that can save you money on electricity every day.

Hawaii Solar Options for Off Grid Electricity

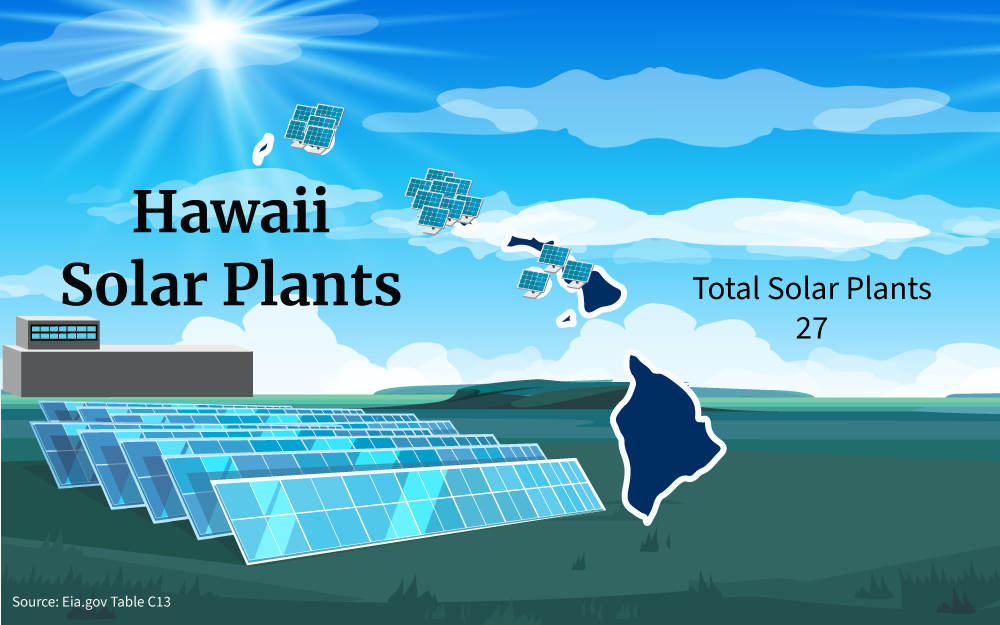

About 1.4 million people live throughout the Hawaiian Islands.4 Some solar industry-based studies suggest that Hawaii is the 15th-best state for residential homeowners to invest in solar energy.5

That same study also suggests that over 400,000 residential homes and commercial facilities have solar panels installed on their rooftops.

Additionally, the Solar Energy Industries Association ranks Hawaii’s solar market in the 16th place across the country.

Some other studies relative to the same subject are a little more conservative: about one-third of Hawaii’s 1.4 million population, specifically single-family homes, have a solar panel array on the rooftop.6 That estimate is over double the same amount of single-family homeowners with solar panels in California.

While there was a 55% increase in new solar panel array installations in Hawaii in 2020, that was a relative boom for one solar installation company.7

Many more Hawaiian households should be investing in solar panels and taking advantage of the plentiful federal and state-sponsored solar tax credits, incentives, and rebates available.

The typical Hawaiian family household generated about $83,100 in annual median income, which is not a lot in a state with a high cost of living standard.8 Over 12.7% of Hawaiians live alone and make a lot less than the median income estimate.

However, investing in solar energy with the help of Hawaii solar incentives should be an option for Hawaiian homeowners.

Programs That Hawaii Is Using To Make Solar Panels Affordable to Residents

The American federal government as well as local state and municipal governments are offering a variety of solar-based tax credits, incentives, and rebates.

Hawaii offers a lot more solar tax credits and incentives than other states; some states don’t even offer state-level solar tax credits.

Although the solar tax credit is not a new concept, in 2022, the American government ratified the Inflation Reduction Act, which among other things extended the opportunity for Americans to get federal-level solar tax credits at 30% until 2034.15

The marketing push to encourage Americans to switch to solar is not prevalent yet, but it will be in years to come. The government wants you to convert to solar sooner rather than later and is offering solar tax credits as a financial incentive for investing in solar photovoltaic panel systems since it is expensive.

The federal-level solar tax credit is known as the investment tax credit or ITC.16 As long as you are the homeowner and wholly own your residential solar panel system then you can get a 30% solar tax credit against your investment costs using the solar tax credit.

While you will learn about several Hawaii-based state and local-level solar tax credits, the most advantageous solar tax credit you will qualify for is the ITC.

Federal Solar Tax Credit Basics

Solar tax credits are a dollar-per-dollar reduction in tax debt relative to the percentage of the tax credit. As previously mentioned, a 5 to 5.5 kWh solar panel array in Hawaii might cost up to $15,000.

(Please keep in mind that this is an average-based estimate. Your costs might be higher or lower depending on your circumstances.)

Imagine that you just paid $15,000 for a 5 kWh solar array. Since most Hawaiian households use about 531 kWh of energy consumption monthly, you may not have to buy a more expensive solar panel system.2

Since the ITC offers a 30% solar tax credit, your initial solar tax credit investment will be reduced by $4,500 after you apply for the ITC. So, your residential solar panel system will cost $10,500 after applying the credits.

A solar tax credit is not the same as a solar tax rebate or a tax deduction. A solar tax rebate is a different kind of solar tax incentive; a rebate allows you to get a reimbursement check after paying for a service or goods.

A tax deduction for solar panels doesn’t really exist; a tax deduction is usually deducted from a gross income, relative to how many business exemptions you want to write off, to reconfigure your final tax obligation.

A solar tax credit is a one-time tax credit, although you can apply again if you move to a new home, city, or state and get a new solar panel system.

Federal Solar Credit Conditions and Enrollment

There is no upper limit to the amount of money you can claim for a solar tax credit against your initial investment. Most homeowners who apply for an ITC get a $7,500 solar tax credit relative to their original investment costs.17

The ITC is nonrefundable and can’t be cashed out if you owe zero in taxes. So, if you owe nothing in taxes, your applicable solar tax credit will spread out over your next few year’s worth of tax returns until it is used up.

The most important thing to remember is that the ITC, and most other state-level solar tax credits, incentives, and rebates can only be applied to PV solar panel systems.

You can use the ITC to recoup 30% of your solar panel installation expenses like parts, PV solar panel equipment, contractor and labor costs, and all costs directly related to the labor and installation of your system.

This federal solar tax credit will cover costs like equipment, solar contractor and labor costs, rack and mounting equipment, photovoltaic solar panel modules, inverters, wiring, solar water heaters, wind turbines, solar hot water pumps, and solar battery storage equipment.

You can get some state-level solar tax rebates if you get residential solar energy battery systems. (More on that later) Over 78% of Hawaii homeowners who own a residential solar panel array installation also own a solar energy battery system.

To ultimately qualify for an ITC, you must own a home in an American state, reside there most of the year, and wholly own the residential solar battery system. Additionally, the equipment must be currently active and provide the homeowner with solar energy.

Like all of the solar tax-based credits, incentives, and rebates you will find in this comprehensive guide, this is a one-time credit.

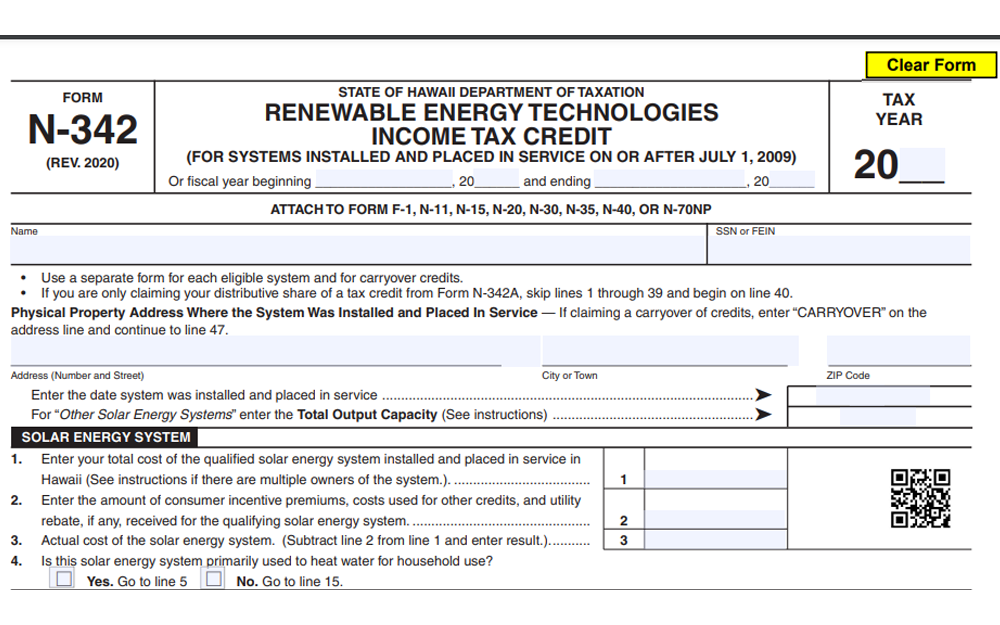

Hawaii’s Renewable Energy Technologies Income Tax Credit (RETITC)

The RETITC is Hawaii’s state-level solar tax credit that offers a 35% solar tax credit that can claimed up to $5,000 worth of the cost of your solar panel investment.

And you can add this 35% state-level credit along with the 30% federal-level ITC.

The RETITC can only be used for photovoltaic-based residential solar power systems.

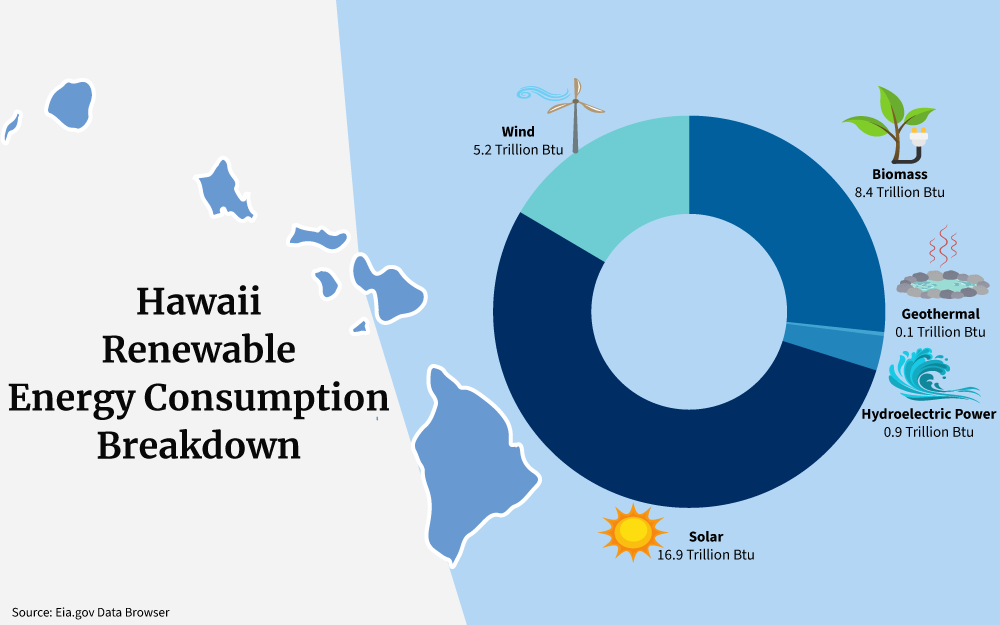

If you install wind energy turbines on your property, you can gain a 20% RETITC solar tax credit. If you install a solar energy hot water heater to be powered with your PV residential solar power system, you can apply another 35% RETITC solar tax credit for the expense of the appliance.

Your home solar panel system must have a 5 kWh system rating to qualify for the tax credit.

To file for a RETITC solar tax credit, you have to download form N-342 from the Hawaii State Taxation website.19

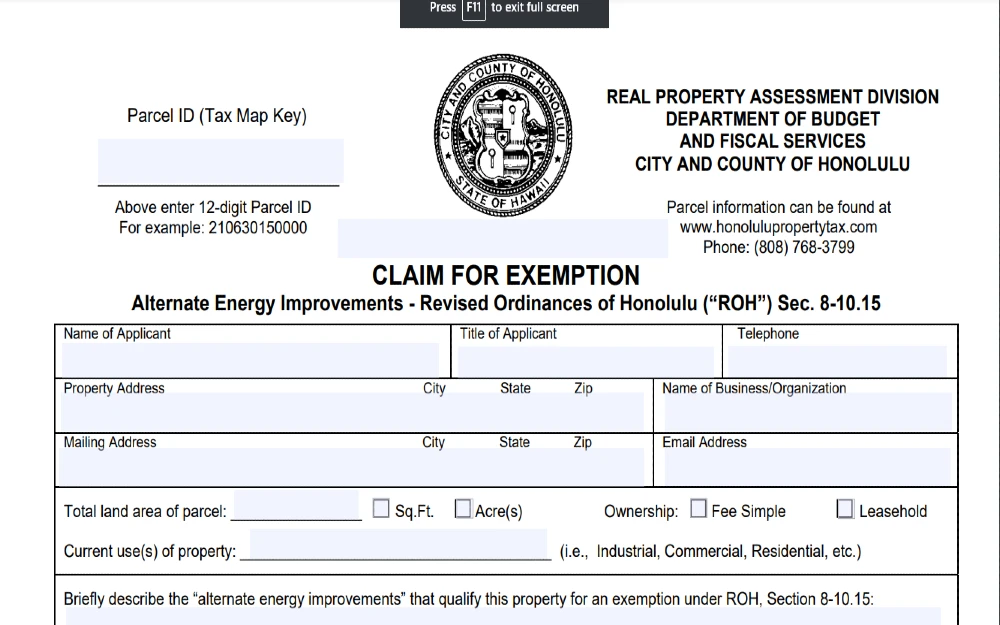

Hawaii’s Oahu Property Tax Exemption for Green Energy Credits

The current property tax rate in Hawaii is about 0.35%, which is arguably the lowest in the United States.20

The third largest island, Oahu, is also the most populated island in Hawaii and contains the city of Honolulu.

If you invest in a residential solar power system in Hawaii, then your property taxes won’t increase for at least 25 years. The average market value of a Hawaiian home is at least $836,677.21 Homes on the real estate market with solar panel installations sell for over 4% more than homes for sale without them.22

Hawaii’s Community-Based Renewable Energy Initiative

The Community-Based Renewable Energy Initiative is a green energy initiative that was passed in 2015 to increase the number of Hawaii residents who invest in solar energy, offer local incentives, and encourage program expansion.23

The program is also available to Hawaiians who don’t have a solar panel system to encourage them to invest in solar. You must subscribe to the Community-Based Renewable Energy Initiative based on the island you live on. And you must commit to getting your energy generated by the local energy collective that you sign up with to benefit from long-term bill savings.

You will save money by drawing your solar-derived energy from the collective capacity that is generated by the local collective, a program bound to inspire more Hawaiians to invest in solar in the future.

You can subscribe to the Community-Based Renewable Energy Initiative on Hawaiian islands like The Big Island, Oahu, Molokai, Maui, and Lanai.24 The amount of bill savings you could gain by subscribing to a local collective depends on the length of your subscription commitment and consuming 531 kWh of energy annually.

You could save about $955 annually or up to $19,116 over 20 years by subscribing to such a collective.24

Hawaii Net Metering

Hawaii officially discontinued its net metering mandate in 2015. While there are many Hawaiian energy companies that offer net metering, it is entirely on their terms and won’t really financially benefit you in the long term.

It is advised that you contact several energy companies that offer net metering and compare their rates. However, you may want to wait until the Hawaii state government brings back net metering and ratifies laws that benefit homeowners before enrolling in such programs.

Hawaiian Electric Battery Bonus Rebates

If you are a customer of Hawaii Electric then you can get a rebate of $850 for every kW of solar energy you consume after you install a solar battery on your property.25

This rebate can be applied to new or already existing and operating residential solar panel systems owned by customers of Hawaiian Electric.

You will have to enroll in the program for at least a decade and facilitate the permit, contractor commissioning, and testing of installed equipment as well.

Kauai Island Utility Cooperative

If you are a member of the Kauai Island Utility Cooperative then you apply for a $1,500 zero-interest loan or preferably a solar-based rebate if you replace an electric water heater on your property with a solar energy-powered version.26

You will have to refer to the official Kauai Island Utility Cooperative’s official website to apply. Additionally, you will have to hire solar energy contractors commissioned by the Kauai Island Utility Cooperative to take advantage of the rebate.

Hawaii Energy Solar Water Heating

In addition to the solar rebates residents in Hawaii can register for, the Hawaii Energy provider offers a $1000 solar water heater rebate, that can be combined with federal EERE program discounts.

Moreover, you can obtain a $500 rebate for solar water heater tune ups, which ensure the maximum lifecycle of the appliance.

Net Metering Explained

Net metering is a solar energy buy-back program by which state energy utility companies buy the excess solar energy generated by customers with residential solar energy installations.

A solar panel contractor will install a smart meter that can calculate how much solar energy your system generates, the excess, and how much your household consumes.

Hawaii discontinued its net metering programs a few years ago. Some net metering-like programs do exist in variant forms, but they mainly benefit the utility companies that offer them.

Are “Free Solar Panels” Offers Legitimate?

Understand that anything that sounds too good to be true usually is a con job. Use discretion when considering any solar products.

So, can you get solar panels for free? No, not really.

Some solar power contractors and companies offer power purchase agreements and leasing and renting offers. They might install the solar panels for free on your property, but the installer will own them, so they are not free.

The installer may require you to sign a long-term rental or lease agreement for the solar panels. Then, you will usually pay a fixed-rate bill for the energy the panels generate.

But since you don’t own the panels, the installer will qualify for an ITC and RETITC tax credit, not you. Additionally, the installer may generate more energy from the panels than you know about (you don’t own them) and sell the energy to others without cutting you in on the profits.

What Do You Need To Qualify for Solar Credits?

As long as you live in an American state and own your home and solar panel system, you should almost automatically qualify for a federal-level solar ITC.

But the most essential condition to be eligible for the solar tax credit is that the solar PV system installed in your residence be under your name. Leased systems are not accepted in the program; you have to be the one to own it.

It also needs to be newly installed or operated for the first time.

Required Solar Tax Credit Documentation

Maintain meticulous record keeping as you will have to include additional documents with the IRS 5695 like photographs that detail the installation process, related inspection and permit documents, and all bills from the solar panel contractor you commissioned for the installation.

Keep these records for at least 7 years.

How To Apply for a Solar Tax Credit

To apply for the solar tax credit, all you have to do is file IRS Form 5695 along with your next tax return.18

To protect your own financial interests, you may want to hire an accountant or tax specialist to help you through this process.

But just to give you an idea, here are the most basic steps to claim the credit:

Step 1: Check your eligibility.

See to it that you tick all the boxes to qualify for the federal solar tax credit. Go back to the section for this above so you won’t miss anything.

Step 2: Prepare the documents.

Download Form 5695 from the IRS Website and print it out. Gather all other necessary documentation such as permits, receipts, and contracts, and be ready to attach them to the form later.

Step 3: Fill out Form 5695.

Write in the information needed for the form, the most important of which are the “numbers” from your installation such as the system’s size and production, the gross cost of the system, and the cost after all other rebates are applied.

You can find line-by-line instructions for this from the IRS website,30 but to make it more efficient for you, it is advisable to ask a finance professional or accountant for advice.

Hawaii Electricity Costs: How Solar Saves Money

While the average cost to invest in solar panels could be as low as $15,000 for home installation, which is a lot for the average Hawaiian household, such an investment could be fully paid off sooner rather than later with the aid of solar tax investments, which most Hawaiians would almost automatically qualify for.

Due to Hawaii’s Pacific-based remoteness from the contiguous 48 states, the state’s perpetual need to import goods and services, including energy, and ridiculously high cost of living standards, Hawaii citizens pay the most for their monthly electricity needs than citizens from any other American state.

The typical American homeowner is burdened with a $121.01 monthly electricity bill.2 The average household in Utah pays $80 monthly for their energy needs. Those who live in Alabama usually pay $147.75 monthly.

Most Americans living in the contiguous 48 states pay for 600 to 1,000+ of monthly kwH of energy consumption. The typical Hawaiian home pays over $177.78 every month to pay for their electricity needs. The typical Hawaiian home barely uses over 531 kWh of utility electricity every month.

But that $177.78 estimate is based on a conservatively polite 2021 United States Energy Information Administration study based on monthly energy bill payment averages. Some experts believe that the average Hawaiian household pays anywhere between $300 to $400 monthly to pay their energy bills.3

What Materials and Parts Do You Need for Solar Panel Systems?

Typically, you may only have to pay $15,000 for a 5 kWh solar panel array in Hawaii.

A solar panel system is usually comprised of PV solar panels which are made of glass, aluminum, silicon, plastic, and other materials. Additionally, such systems required rack and mounting materials to install them on rooftops, wiring, and inverters.

Solar panels generate energy with a DC current. Since American homes operate on an AC current, the solar power inverter converts DC current into AC so that it can be used in households and stored in solar batteries.

How To Use a Residential Solar Panel Calculator

You may need up to 21 photovoltaic solar panel modules installed on your rooftop to offset up to 100% of your total energy consumption needs.27 You should consult with a solar panel contractor to customize calculations to determine how many solar panels you may require for your home.

To calculate how many solar panels you will need, you need to consider multiple factors.

You have to estimate how much energy you consume annually, the wattage of the solar panel modules you will use, and project how much energy your solar panels will generate once installed.

So, if you divide the size of the proposed system by the projected energy generation ratio and then divide that number by the wattage, you should be able to calculate how many solar panels you need.

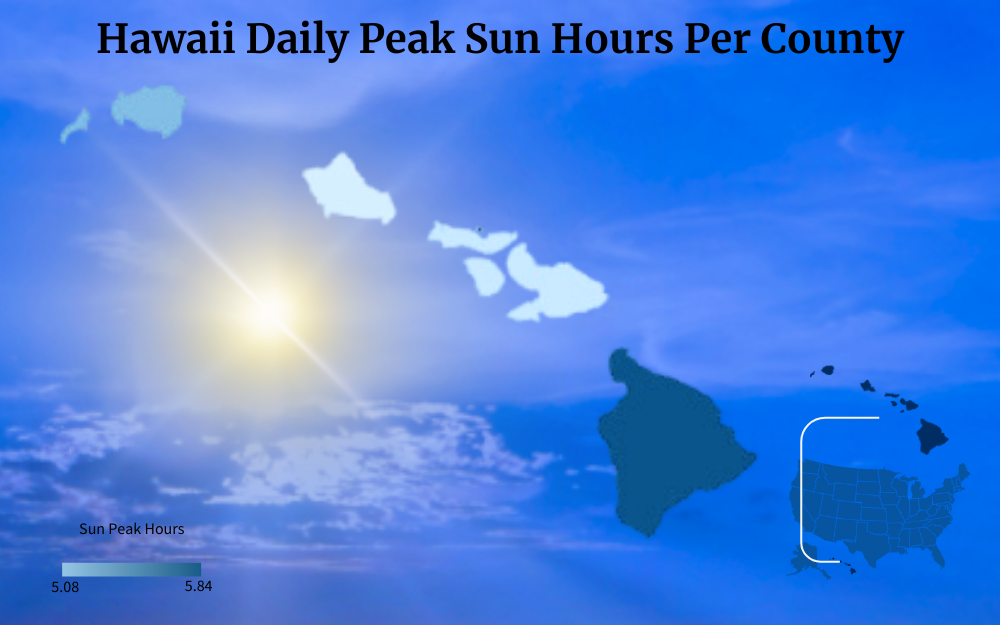

You may also need to determine how many hours and days of direct sunlight shines on your property as well.

It might also be easier to hire a solar panel contractor, have them visit your home to inspect it, and help you calculate such through a paid consultation.

A solar panel calculator by address metric system called the PVWatt Calculator also exists. You have to input a lot of data to calculate how many solar panels you will need and how much energy you can generate.28 If you are not an electrician or solar panel expert, you may want to use this with a solar panel contractor.

The most important solar panel savings calculator is to figure out when your solar panel system will pay for itself.

You can save at least $1,500 annually on your energy costs after installing a residential solar panel array.29 The typical Hawaii home pays at least $177.78 annually for its energy burden. (As previously mentioned, this is probably a very low average estimate.)

That means a Hawaiian household pays $2,133.36 annually for electricity. Over a decade, that amount increased to over $21,336.

After applying a 30% federal ITC solar tax credit, the cost of a $15,000 5 kWh solar panel system reduces to $10,500. After applying for a 35% RETITC solar tax credit, that $10,500 estimate is further reduced to $6,825.

So, if you save $1,500 annually with solar power, then you can pay off your investment in about four and half years. Using that same estimate, if you are paying $21,336 annually for energy, then your entire energy bill could be offset by exactly $21,000 within 14 years.

The Hawaiian renewable portfolio standard, which aims to generate 100% of the energy within the state via renewable sources, could just be getting started by then. And while other Hawaiians are just beginning to convert to solar, you may have long recouped your costs by then.

How To Choose Solar Panels in HI

Exert due diligence when choosing a solar panel contractor in Hawaii. You may experience solar panel problems at some point since the life expectancy of solar panels is at least 25 years but require regular maintenance checks.

So, make sure that they get installed the right way the first time.

Assess if Your Home Needs Renovations

Make sure that your rooftop and the integrity of your home can withstand having solar panels installed.

You may need to get your home inspected, have the roof reinforced or replaced, or enact some renovations before you have a solar panel system installed.

Installing a solar panel system on a compromised roof or structure could damage the system, and your home, decreasing your home’s market value, and making you spend even more money to fix the issues.

Research a Few Contractors

Never choose the first contractor you find on Yelp to install solar panels that will affect the energy consumption of your home for decades to come.

See if you can get a referral from coworkers, friends, or relatives. Or make a detailed list of local contractors and compare their skills and rates.

Ask for a Consultation

Don’t be a passive bystander in this process. Ask for an on-site consultation to see how the contractor will work with you. Will they do the work and ignore you or involve you and keep you apprised every step of the way?

Make a list of questions to ask about the project. Don’t be afraid to ask, “What is PV?” or “What is a solar cell” or “What is a solar panel?”

Ask for a work quote or a written service plan detailing how they will install the system. Ask them to calculate for you how many solar panels you will need, how much energy they will calculate, and where they will be placed.

Always Vet

Do not be shy about vetting a solar energy contractor. If you choose the wrong one, it could cost you a lot in the long term.

Call or email some from your research list and ask about their credentials, experience, skills, client references, insurance policies, and if they are licensed and certified.

Narrow down your list as you go along to find the best contractor for your needs before buying solar panels for house energy consumption optimization.

Why Hawaii Homeowners Pay So Much for Energy and Why It’s Better To Invest in Solar Now

The biggest reason why Hawaiians pay so much more for energy than the other 49 states is because of its remoteness and lack of natural resources.

Hawaii uses over seven times more energy than it actually produces within the state.4 So, Hawaii imports a lot of goods and resources to maintain its living standards. The war in Ukraine waged by Russia disrupted supply chains globally and inflamed inflation; over a third of the oil used in Hawaii came from Russia.6

A lot of the oil and natural gas in Hawaii are burned to generate electricity. Over 60% of the electricity generated in all 50 states is created through the burning of coal and natural gas, and to a lesser degree, oil.9 Now that inflation is rampant and oil is scarcer, energy prices have increased.

Electricity bills in Hawaii surged by over 34% in April 2023 due to the war in Russia.6

On top of this reality, Hawaii has one of the highest cost of living standards in the country along with states like New York and California. However, Hawaii’s cost of living problems are more pronounced because of its remoteness.

Still, there are numerous reasons why Hawaii homeowners should strongly invest in solar equipment.

Hawaii is only 1,470 miles above the equator which means that sunlight hits solar panel arrays more directly than those in the contiguous United States.10 Hawaii usually receives over 270 days of partly to full sunny days every year.11 As such, residential solar panel arrays in Hawaii will be able to absorb more direct sunlight than those located in the contiguous United States.

Additionally, the Hawaii state government ratified a law in 2015 called the renewable portfolio standard that would mandate that the entire state generate energy only from renewable sources by 2045.12 By 2045, the entire state aims to have all of its energy generated via renewable sources; Hawaii gains over 21% of its electricity via renewable energy right now.

Even if the state’s renewable portfolio standard mandate is delayed by years or decades, which is a distinct deniability, there is no denying that Hawaii will be heading toward a renewable energy future. The state has to due to its cost of living problems while many states in the contiguous United States have more time to just contemplate the choice.

It is in your best interest as a Hawaii homeowner to invest in residential solar a lot sooner rather than later. The aforementioned federal and Hawaii solar incentives and tax credits are more plentiful than those made available in the contiguous states.

Investing in home solar systems is expensive, but the typical Hawaiian household may only need to invest in a 5 to 5.5 kWh solar panel rooftop array at a cost of around $15,000.13 But if you were able to qualify for every available Hawaii solar tax credit or incentive, then you may be able to recoup up to 90% of your initial solar investment costs over time.

The state of Hawaii has invested over $4.4 billion in its future conversion plans to fully commit to renewable energy, especially solar power energy.14 Get ahead of the curve and take advantage of the green energy credits that you may already qualify for but don’t know about.

The official state motto is the saying “Ua mau ke ea o ka aina i ka pono,” which roughly translates to “The life of the land is perpetuated in righteousness.”1

Understanding Hawaii solar incentives and how they can save you money, while keeping the pristine wilderness and lush areas in the state safe from fossil fuel impacts, is the first step in becoming energy independent.

Frequently Asked Questions About Hawaii Solar Incentives

Are There Any Drawbacks to Solar Energy?

Any problems with solar energy are dwarfed by their benefits. They reduce the need to rely on fossil fuels and don’t leave carbon footprints, besides their initial manufacturing process, which is still negligible.

How Long Do Solar Panels Last?

The typical solar panel will last anywhere between a quarter of a century and up to 30 years. To make sure that they last a long time, you should have a contractor inspect them on a regular maintenance schedule and regularly monitor the energy generation of the panels.

Do Solar Tax Credits Expire?

Have you ever wondered “When do federal credits expire?” Well, the current 30% solar tax rate will stay in place until 2032; in 2033, the rate will decrease to 26%, and by 2034, it will fall to 22%. The federal ITC will be discontinued by 2035.

References

1Capitol Hawaii.Gov. (2023). 5 – 9 State Motto. Capitol Hawaii.Gov. Retrieved September 8, 2023, from <https://www.capitol.hawaii.gov/hrscurrent/vol01_ch0001-0042f/hrs0005/HRS_0005-0009.htm>

2EIA. (2023). 2021 Average Monthly Bill- Residential. EIA. Retrieved September 8, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf >

3Startsman, Scott. (2023, March 19). Hawaii Utility Costs – Adding Up The Cost Of Living In Hawaii. HIEstates. Retrieved September 8, 2023, from <https://www.hiestates.com/blog/hawaii-utility-costs-adding-up-the-cost-of-living-in-hawaii>

4EIA. (2023). Hawaii State Energy Profile. EIA. Retrieved September 8, 2023, from <https://www.eia.gov/state/print.php?sid=HI>

5Glover, Emily. (2023, February 24). The Best And Worst States For Solar Energy 2023. Forbes. Retrieved September 8, 2023, from <https://www.forbes.com/home-improvement/solar/best-worst-states-solar/ >

6Penn, Ivan. (2022, May 30). Hit Hard by High Energy Costs, Hawaii Looks to the Sun. The New York Times. Retrieved September 8, 2023, from <https://www.nytimes.com/2022/05/30/business/hawaii-solar-energy.html>

7Sylvia, Tim. (2021, January 27). Hawaiian Electric saw a 55% increase in home solar installations in 2020. PV Magazine. Retrieved September 8, 2023, from <https://pv-magazine-usa.com/2021/01/27/hawaiian-electric-saw-a-55-increase-in-home-solar-installations-in-2020/>

8Hawaii State Data Center. (2023, September 17). 2019 AMERICAN COMMUNITY SURVEY, 1-YEAR ESTIMATES. Hawaii State Data Center. Retrieved September 8, 2023, from <https://census.hawaii.gov/wp-content/uploads/2020/10/acs2019_1-yr_DBEDT-highlights.pdf>

9EIA. (2023). What is U.S. electricity generation by energy source? EIA. Retrieved September 8, 2023, from <https://www.eia.gov/tools/faqs/faq.php?id=427&t=6 >

10Thanh Son, Nguyen. (2023, March 24.) 22 How Close Is Hawaii to the Equator? Thcsthanhsonnugyen. Retrieved September 8, 2023, from <https://thcsnguyenthanhson.edu.vn/22-how-close-is-hawaii-to-the-equator-full-guide/>

11ElectricRate. (2023). Hawaii Solar Power Facts in 2023. ElectricRate. Retrieved September 8, 2023, from <https://www.electricrate.com/solar-energy/hawaii/>

12Savenije, Davide. (2015, May 6). Hawaii legislature sets 100% renewable portfolio standard by 2045. Utility Dive. Retrieved September 8, 2023, from <https://www.utilitydive.com/news/hawaii-legislature-sets-100-renewable-portfolio-standard-by-2045/394804/>

13Simms, Dave. (2023, August 31). Do Hawaii Solar Incentives Make It Affordable for Homeowners to Go Solar? EcoWatch. Retrieved September 8, 2023, from <https://www.ecowatch.com/solar/incentives/hi>

14SEIA. (2023). Hawaii Solar. SEIA. Retrieved September 8, 2023, from <https://www.seia.org/state-solar-policy/hawaii-solar>

15WhiteHouse.Gov. (2023, January). Building a Clean Energy Economy. WhiteHouse.Gov. Retrieved September 8, 2023, from <https://www.whitehouse.gov/wp-content/uploads/2022/12/Inflation-Reduction-Act-Guidebook.pdf >

16Energy.Gov. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.Gov. Retrieved September 8, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics >

17Rosen, Andy. (2023, August 1). Solar Tax Credit: What It Is and How It Works In 2023. NerdWallet. Retrieved September 8, 2023, from <https://www.nerdwallet.com/article/taxes/solar-tax-credit>

18IRS. (2023). Residential Clean Energy Credit. IRS. Retrieved September 8, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

19State of Hawaii Department of Taxation. (2023). Renewable Energy Technologies Income Tax Credit (RETITC) – HRS §235-12.5. State of Hawaii Department of Taxation.Retrieved September 8, 2023, from <https://tax.hawaii.gov/geninfo/renewable/ >

20David, Leonardo. (2023, September 7). Hawaii Solar Tax Credits, Incentives and Rebates (2023). MarketWatch. Retrieved September 8, 2023, from <https://www.marketwatch.com/guides/home-improvement/hawaii-solar-incentives/>

21Zillow. (2023). Hawaii Home Values. Zillow. Retrieved September 8, 2023, from <https://www.zillow.com/home-values/18/hi/>

22Brill, Rebeca. (2023, September 6). Do Solar Panels Increase Your Home’s Value? Retrieved September 8, 2023, from <https://www.forbes.com/home-improvement/solar/does-solar-increase-home-value/>

23Hawaii State Energy Office. (2023). Community-Based Renewable Energy. Hawaii State Energy Office. Retrieved September 8, 2023, from <https://energy.hawaii.gov/get-engaged/community-based-renewable-energy/ >

24Simms, David. (2023, August 31). Do Hawaii Solar Incentives Make It Affordable for Homeowners to Go Solar? EcoWatch. Retrieved September 8, 2023, from <https://www.ecowatch.com/solar/incentives/hi >

25Hawaiian Electric. (2023). Customer Renewable Programs. Hawaiian Electric. Retrieved September 8, 2023, from <https://www.hawaiianelectric.com/products-and-services/customer-renewable-programs/rooftop-solar/battery-bonus>

26Kauai Island Utility Cooperative. (2023). Solar Water Heating Programs. Kauai Island Utility Cooperative. Retrieved September 8, 2023, from <https://kiuc.coop/solar-water-heating-programs>

27Aggarwal, Vikkram. (2023, June 8). How many solar panels do I need for my home in 2023? Energy Sage. Retrieved September 8, 2023, from <https://www.energysage.com/solar/solar-101/how-many-solar-panels-do-i-need/ >

28NREL. (2023). NREL’s PVWatts® Calculator. NREL. Retrieved September 8, 2023, from <https://pvwatts.nrel.gov/>

29Crail, Chauncey. (2023, July 28.) How Much Do Solar Panels Save The Average Homeowner? Forbes. Retrieved September 8, 2023, from <https://www.forbes.com/home-improvement/solar/how-much-solar-panels-save/>

30Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). Internal Revenue Service. Retrieved September 13, 2023, from <https://www.irs.gov/instructions/i5695>

31Hawaii.gov website screenshot of Renewable Energy Technologies Income Tax Credit form. Hawaii.gov. Retrieved from <https://files.hawaii.gov/tax/forms/2020/n342_i.pdf>

32Rooftop Solar Panels – Mililani, Oahu, Hawaii Photo by Tony Webster / Attribution 2.0 Generic (CC BY 2.0). Resized and Changed Format. From Flickr <https://www.flickr.com/photos/diversey/49551124526/sizes/l/>

33Screenshot of Claim for Exemption. City and County of Honolulu. Retrieved from <https://www.realpropertyhonolulu.com/media/1403/bfsrpp5d.pdf>